So your company has 1,000 paying customers today, things are looking really good. You’re closing a lot of deals with new customers; everything is headed in the right direction… except for one thing. Right now you’re losing about 8% of your customers every month. Twelve months from now, that cohort will be down to ~370 paying customers. Even if you keep your new customer sales strong, it’s going to be tough to do much more than stabilize your revenue numbers! Not good news, and unfortunately, it gets worse. Acquiring new customers is going to get tougher and your customer acquisition cost will almost certainly go up. With customers leaving at an alarming rate, it’s starting to look like its time to raise more capital. Unfortunately, this could be really challenging, and even if you can raise capital, your valuation will have taken a serious hit, so everyone’s equity will be getting diluted in a big way. Of course equity dilution may not be your biggest concern since at this point, you may need to seriously consider the viability of your company, not the size of the equity event.

You could be thinking, sure this is probably all true in theory, but how realistic is it? Could this ever happen to a company that is by any definition a good one, might less a great one? The answer is yes, because it has. The company was Salesforce. How serious was it? Well, in an Inc. articlewritten by Matt Given, he suggested that churn was: “The One Word That Saved Salesforce From Certain Doom”.

This isn’t one of those “10 people in a garage” pivot stories. In June of 2004 Salesforce went public. In the following spring at an executive offsite, David “Doomsday” Dempsey, the executive that founded Salesforce EMEA, announced that Salesforce’s churn was ~ 8% a month. That’s a little bit more than 63% per year! Clearly, something had to be done.

Salesforce: Customers for Life & Customer Success

To address this issue Salesforce created the “Customers for Life” group with the direct mission of assisting customers to be successful with the product. The focus and dedication that followed was a milestone in the evolution of Customer Success and had a huge impact on the profession. How huge? It’s fair to say that without making their customers Successful, Salesforce would not be what it is today. The essential lesson of the story is that if you’re a software company, you need to be sure that your customers are getting increasing value from their relationship with you.

It would be a mistake to assume that with this revelation, Salesforce simply avoided “certaindoom”. This wake up call focused them on a problem, that when addressed, was instrumental in driving their stock price from approximately $1B at IPO to over $120B today. When you look at the numbers, Salesforce’s newfound ability to help customers succeed drove down churn, which in turn drove up their Customer Lifetime Value (LTV). Driving up LTV, in turn, drove their cost of revenue down, and this enabled them to engage in an extremely aggressive new customer acquisition strategy. Bottom line, the amount of money they were willing (and able) to spend to acquire new customers was the direct result of great net-churn.

The Numbers Don’t Lie

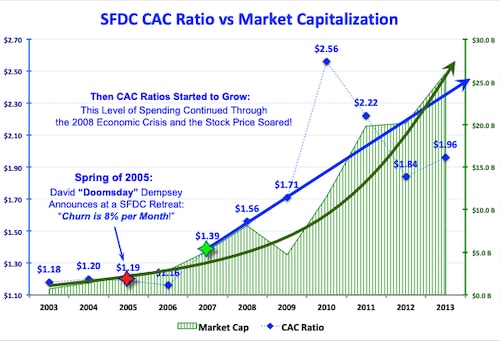

To quantify the impact of Salesforce’s success from resolving their churn problem, take a look at the graph to the right. The blue line shows Salesforce’s Customer Acquisition Cost (CAC) ratio. The CAC ratio is the amount of money that a company spends to acquire one dollar of new Annual Recurring Revenue (ARR). In 2004 when Salesforce went public, they were spending ~$1.20 for $1.00 of revenue. This remained relatively flat until 2 years later when, according to Salesforce senior executives, the customers for life program had started to have a major impact. In 2007, as the gross churn problem was resolved, the focus shifted back to the acquisition of new customers. By 2007 their ability to retain customers allowed them to take an extremely aggressive position on spending to acquire new customers. From a low of $1.16 in 2006 their CAC ratio grew to over $1.50 in 2008 and continued to increase in 2009 even though the subprime mortgage crisis was taking it’s toll on stock markets. As the economy began to show signs of life, their CAC ratio went through the roof to over $2.50. At the same time their Market Cap (represented in green) also went through the roof! Ultimately Salesforce’s success wasn’t the result of their ability to close deals with new customers; it was their ability to keep those customers by making them successful.

To quantify the impact of Salesforce’s success from resolving their churn problem, take a look at the graph to the right. The blue line shows Salesforce’s Customer Acquisition Cost (CAC) ratio. The CAC ratio is the amount of money that a company spends to acquire one dollar of new Annual Recurring Revenue (ARR). In 2004 when Salesforce went public, they were spending ~$1.20 for $1.00 of revenue. This remained relatively flat until 2 years later when, according to Salesforce senior executives, the customers for life program had started to have a major impact. In 2007, as the gross churn problem was resolved, the focus shifted back to the acquisition of new customers. By 2007 their ability to retain customers allowed them to take an extremely aggressive position on spending to acquire new customers. From a low of $1.16 in 2006 their CAC ratio grew to over $1.50 in 2008 and continued to increase in 2009 even though the subprime mortgage crisis was taking it’s toll on stock markets. As the economy began to show signs of life, their CAC ratio went through the roof to over $2.50. At the same time their Market Cap (represented in green) also went through the roof! Ultimately Salesforce’s success wasn’t the result of their ability to close deals with new customers; it was their ability to keep those customers by making them successful.

Are Salesforce’s CAC Ratios an Anomaly?

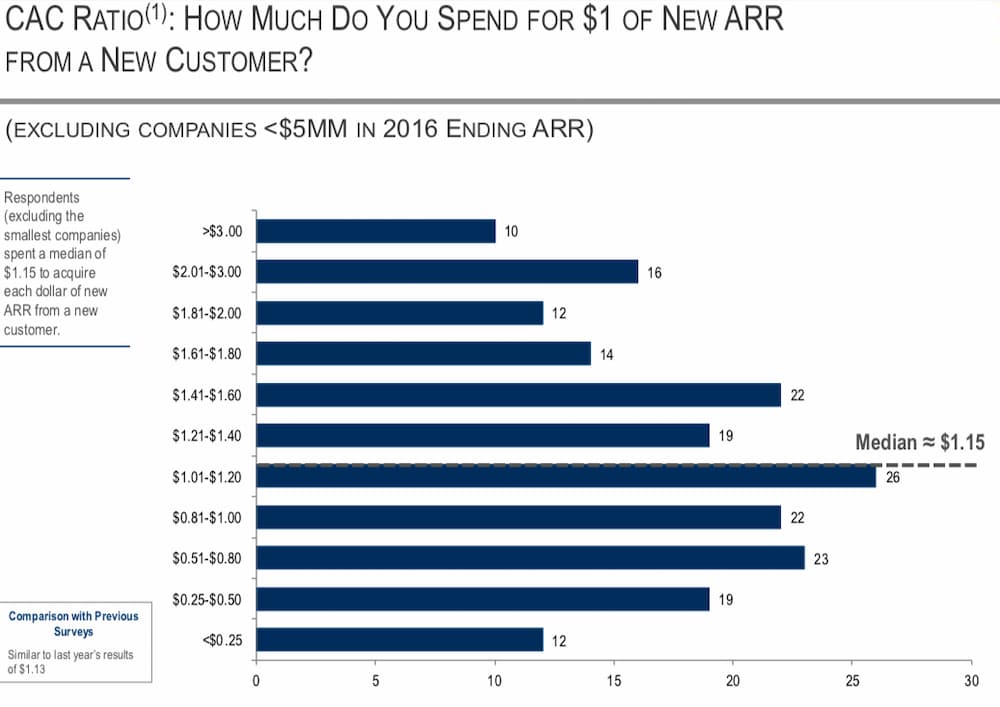

The Pacific Crest Securities’ 2017 Private SaaS Company Survey results below give us a sense for the answer. The research is based on a group of ~ 200 privately held SaaS companies. For these companies, the median CAC ratio is $1.15. This number is up 2% from the previous year and according to ProfitWell’s survey of another 800 companies CACs are up 65% over the last 4 years. Clearly CACs and CAC ratios are not receiving a lot of downward pressure. As for the Salesforce CAC ratios > $2.50, the Pacific Crest data shows companies are spending more than $3.00 today. Regardless of the magnitude, with the median CAC ratio at $1.15 and the 25thpercentile at $1.65, churn and the associated LTV will be critical to the future of any company with a recurring revenue model.

Customer Success – The Financial Perspective

You frequently hear that investors are the driving force behind founders creating customer success teams… and now you know why. Investors focus on the numbers, and the numbers make one thing clear, if you want exponential increases in your valuation, you need to make your customers successful.

Based on this data, a really good argument can be made that Customer Success is the most important organization in well run companies. However this perspective, as you know, is not shared by everyone. The way to change this, of course, is to earn it, and it is earned by delivering results. Achieving these results however, requires the executive team to understand the role of customer success, what the quantifiable financial value is to the company, and what level of investment is required for a customer success organization to drive the company’s continued success.

Customer success executives often talk about the importance of “having a seat at the table” to do this. What needs to be understood is that this “seat” is necessary, but not sufficient.Customer Success exists to drive the company’s focus on the success of their customers, to drive profitabilty, to improve the product… but none of this will happen by simply having a “seat at the table”. It requires that you also have a “voice at the table”. Having the influence and ability to garner the resources and commitment needed to drive a company’s future requires that you’re heard at the table. To do that, you need to speak the language of the table, and that language is one based on numbers, financial numbers.

As such, this series of articles on The Economics of Customer Success is really a language course, one designed to help you increase your fluency in the language of the table.

Tom Lipscomb

Tom’s career has focused on making customers more successful by delivering quantifiable business value. The expertise and best practices he leverages for his clients was developed over 20 years as an executive in companies ranging from the Fortune 50 to start-ups in North America, Europe, and Asia. His methodology begins with the creation of a strategy that defines the role your Customer Success organization will play in achieving your business objectives. This strategy is built upon a financial foundation that enables the definition, design, and execution of tactics that deliver vastly superior results in less time.

Tom’s career has focused on making customers more successful by delivering quantifiable business value. The expertise and best practices he leverages for his clients was developed over 20 years as an executive in companies ranging from the Fortune 50 to start-ups in North America, Europe, and Asia. His methodology begins with the creation of a strategy that defines the role your Customer Success organization will play in achieving your business objectives. This strategy is built upon a financial foundation that enables the definition, design, and execution of tactics that deliver vastly superior results in less time.